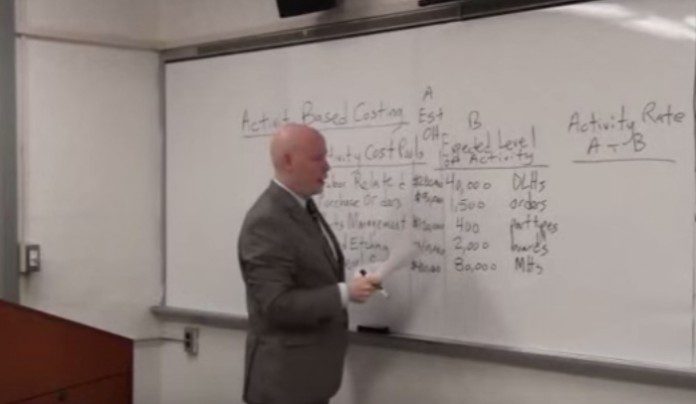

Activity based costing (ABC) is an accounting method to allocate costs based on resource consumption. It is typically used when customized goods are being bought and sold, but can be used in virtually all budgets in some way. Here are the key points to consider when looking at the pros and cons of activity based costing.

The Pros of Activity Based Costing

1. It improves the processes of the business.

Because costs are allocated based on each product instead of an overall view of the goods or services being provided, a better view of the indirect expenses can be obtained. This allows people to reduce costs, potentially reduce pricing, and create more business opportunities.

2. It is useful in identifying waste.

Because all actions have a cost associated with them, ABC is able to locate waste that occurs in an organization very effectively. This happens because a better understanding of overhead costs is obtained.

3. It is extremely flexible.

ABC is a method that can be applied to all overhead costs, unlike traditional accounting methods which only work with overhead costs that are associated with production. It can also be used for product costing or for service costing.

The Cons of Activity Based Costing

1. It does not conform to accounting standards.

ABC is an internal reporting function only. It cannot be used for external reporting because the data can be easily misinterpreted. This confusion can even lead to poor business decisions that might have been avoided if traditional accounting techniques were used internally instead.

2. It can be very expensive to implement.

The only way for ABC to truly work is by breaking down and analyzing all business activities. This means individual components in every area must be completely evaluated. Not only does this often require an extensive time commitment, but there is also usually the need to bring in an ABC expert to make sure the process is correctly implemented.

3. Even if perfectly implemented, it won’t allocate all overhead costs.

Every activity has an overhead cost, but it is impossible to use ABC to have specific activities be allocated. This means that although the system can help to provide insights, it is not 100% reliable for identifying all costs.

The pros and cons of activity based costing show that it has the potential to be extremely beneficial in specific situations. Hidden costs can finally be discovered, even if this method of accounting doesn’t conform to standards.

Crystal Lombardo is a contributing editor for Vision Launch. Crystal is a seasoned writer and researcher with over 10 years of experience. She has been an editor of three popular blogs that each have had over 500,000 monthly readers.