Are you planning to launch a startup? Are you an aspiring entrepreneur? Have you already launched a startup and are now looking for funds? Are you researching various funding sources and intend to find out how venture capitalists work? Do you wish to know how angel funding can be secured?

The VC Term Sheet is a brief but a very helpful guide for you if you wish to crack the big deal. Every startup will reach a stage when it cannot be funded anymore by personal money or grants from near and dear ones. While a startup will start making money of its own but to expand, to grow abruptly and to realize its true potential, there will have to be some fresh funding, that too in copious amounts. Without generous funding that can create a lot of breathing space, a startup will remain confined to a small to medium enterprise. It will never be able to become a brand or a large corporation.

Cracking a deal with any venture capitalist is not a cakewalk. The venture capitalists or those who head hedge funds, investment firms or those who are angel investors, investment bankers and conventional businessmen, are not easy to convince. They have their own way of looking at the world. It is that perspective and vision that segregate them from the rest, the ordinary people living from one paycheck to another.

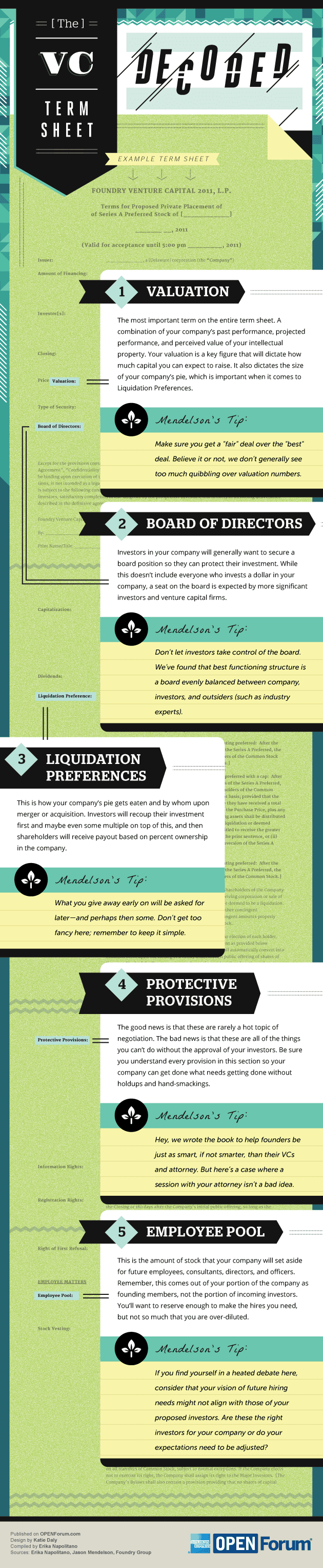

If you wish to convince a VC or an angel investor, you need to know the VC term sheet. That is exactly what you will find in the associated info-graphic.

The VCs are not interested in knowing how you were raised, how amazingly you did at school or what kind of challenges you have faced to create the startup. The VCs will not even be interested in your own plans or your ambitions. They will only be interested in a few things pertaining to the startup, which could be the business, the product, service or the idea. They will be interested in your potential but only to an extent that is relevant for the business. What else you can do with your life or with your talents will be redundant for them, unless those are also relevant for them at some stage or right now.

Check out the five things that matter most for most venture capitalists. You must get accustomed to them and prepare yourself accordingly before you even schedule an appointment.

Strong proponent of individual liberty and free speech. My goal is to present information that expands our awareness of crucial issues and exposes the manufactured illusion of freedom that we are sold in America. Question everything because nothing is what it seems.