The creation of false opposites has been a long-standing obstacle to human progress.

From the ancient pleasure-seeking Epicureans who argued against the logic-heavy Stoics of ancient Rome to the war of “salvation through faith vs works” that schismed western Christianity, to the chaotic emotional energy driving the Jacobin mobs of France whose passions were only matched by the radical Cartesian logic of their Girondin enemies; humanity has long been manipulated by oligarchs who knew how to set the species to war against itself. Although these operations have taken many forms, the desired effect has always been the same: divide-to-conquer bloodbaths which drowned out the saner voices of Cicero (executed in 44 BCE), Thomas More (executed in 1535 CE), or Jean Sylvain Bailly (executed in 1793 CE).

Today’s polarization across the Trans-Atlantic world has reached a fevered pitch with the “right wing conservatives” shouting for liberty and less government while left wing liberals call for more government and top-down reforms of the system (with Great Reset technocrats laughing in the background).

Everyone with half a brain should be able to sense that the danger of civil war and economic meltdown hang over our destinies like a sword of Damocles, but instead of hearing calls for restoring the SCIENTIFICALLY PROVEN traditions of American System banking that author Ellen Brown recently documented in her powerful new essay, we find only feuding sects that assert we must EITHER have top-down centralized planning OR bottom-up free markets laissez faire policies devoid of any government intervention.

To the degree that this false debate continues the overtones of France’s 1789-94 bloodbath will be heard growing louder with every passing day.

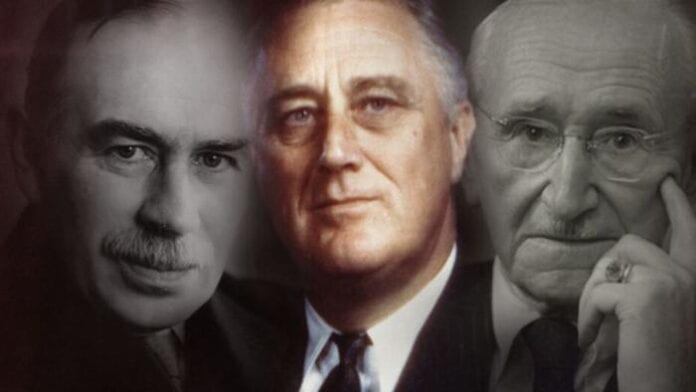

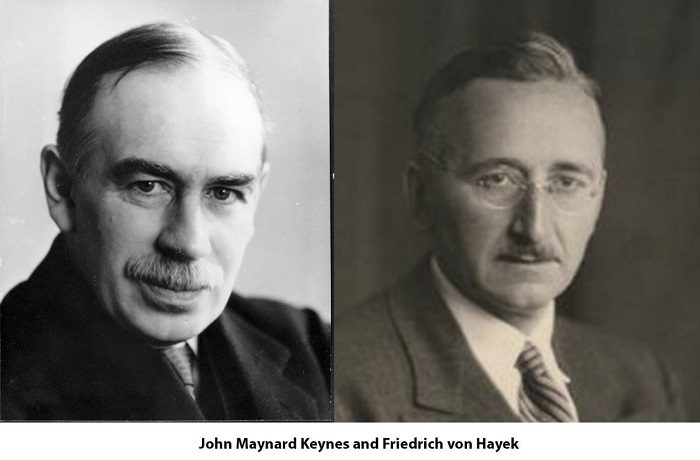

Keynes vs Hayek: A False Dualism

In this first of a three-part series, I will argue that the source of this confusion among Americans was first concocted in London during the height of the depression, centering on the figures of two London-based Malthusian hedonists. One was top-down economist John Maynard Keynes (1883-1946) and the other played the role of his supposed opponent in the form of “bottom up” advocate Friedrich von Hayek (1899-1992).

To put it another way, these two fundamentally anti-republican ideologues whose lives were each devoted to the hereditary systems of empire constructed a widely publicized debate that asserted two opposing economic theories, either 1) government must spend arbitrarily to create jobs OR 2) government must cut budgets, end social safety nets and public services and let the strong survive leaving each unit of society to its own (supposedly) self-regulating passions.

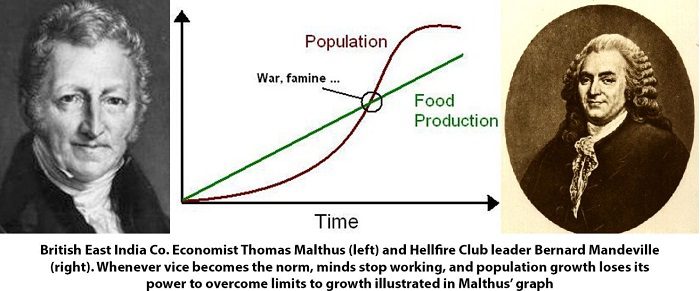

The constants among both apparent opponents (who remained friends throughout their lives) were that 1) neither believed that INTENTION or MIND should govern economic policy (Keynes believed in arbitrary “make work” which could not differentiate between the qualitative difference of a $100 paycheck to a digger of random holes vs $100 paycheck to an engineer building a dam), and 2) both believed equally in the universal validity of Malthus’s population theories, and of Bernard Mandeville’s satanic belief that personal vice creates public virtue. Both theories have underpinned British imperial grand strategy for over two centuries.

It is also important to hold in mind that this 1932 debate emerged at a time that the world government agenda driven by the Bank of England and League of Nations were on the ascendency. This operation, in which both Keynes and von Hayek were thoroughly enmeshed, demanded fascist regimes control the world under a “scientifically managed” bankers’ dictatorship.

One month after the London Times October 17, 1932 publication began to print arguments from proponents of both schools on how to best end the depression, Franklin Roosevelt was elected to the U.S. presidency.

With his presidential victory, a specific form of economic planning was restored to the republic that had nothing to do with either school of Keynes or Hayek and everything to do with something uniquely embedded in the U.S. Constitutional traditions that petrified the hereditary empires of Europe’s old nobility.

In the years leading up to his victory, FDR had worked closely with a grouping of bipartisan American congressmen and senators to revive a form of political economy which involved the paradoxical coexistence of increased government involvement together with massive increase in entrepreneurism, and private sector growth. The fact that FDR is attacked by communists for being a capitalist shill while being simultaneously attacked by capitalists for being a communist shill to this very day is a sign of this ongoing confusion and a testament to the effectiveness of British intelligence propaganda.

The systemic inability for modern Americans to resolve the ‘FDR paradox’ today is due entirely to a sleight of hand pulled by the very same imperial power that has never forgiven the USA for declaring its independence in 1776.

What Ben Franklin Created

When Benjamin Franklin (1705-1790) had orchestrated his life-long project of establishing a new nation on this earth founded upon the principle of the sanctity of the individual (enunciated in the 1776 Declaration of Independence) and the sanctity of the General Welfare (as outlined in the Constitution’s 1787 pre-amble), he and his leading co-thinkers demonstrated a profoundly philosophical understanding of the political economy and also nature of true freedom which citizens must re-learn – quickly.

In order to give practical meaning to the ideals of individual (bottom up) freedom and national (top down) collective well-being enshrined in America’s founding documents, a new system of political economy was created by Franklin and his closest followers among the founding fathers.

This new system did not arise ex nihilo but was itself based upon the greatest traditions of French dirigisme of Jean-Baptiste Colbert (1619-1683), and earlier Cameralist schools of economic planning which grew out of the creation of the first modern nation states of France’s Louis XI and England’s Henry VII. For the first time in history (at least since the short-lived effort by Charlemagne in the 8th century), the idea of “money”, “value”, “profit” were tied not to the passive capital off which feudal landlords fed parasitically, or bounty to be looted, but rather the improvement of the lives of people from whom the legitimacy of government was recognized to originate.

Throughout the 18th century, Benjamin Franklin became a leading American force for this school of thought which was outlined in his 1729 On the Necessity for a Paper Currency. In this influential essay, the young scientist argued for a system of finance, colonial scrip, and value governed by the growth of manufacturing and full spectrum economics. In his essay Franklin battled the British establishment who argued that the colonies should forever remain agrarian, backward and cash cropping, saying:

“As Providence has so ordered it, that not only different Countries, but even different Parts of the same Country, have their peculiar most suitable Productions; and like wise that different Men have Genius’s adapted to Variety of different Arts and Manufactures, Therefore Commerce, or the Exchange of one Commodity or Manufacture for another, is highly convenient and beneficial to Mankind.”

Some of Franklin’s leading protégé’s who carried this tradition into the 19th century included the first U.S. Treasury Secretary Alexander Hamilton (1755-1804), John Jay (1745-1829), Gouverneur Morris (1752-1816), Robert Morris (1734-1806), Isaac Roosevelt (1726-1794) (great-great grandfather to Franklin Roosevelt) and later Henry Clay (1777-1852), John Quincy Adams (1767-1848), Matthew Carey (1760-1839). Matthew Carey’s son Henry C. Carey (1793-1879) became a leading economic advisor to Abraham Lincoln.

All of these figures defended the right of the young republic to develop “full spectrum economics” in order to gain true independence from the City of London.

Henry C. Carey’s Seminal works that rallied the nation’s patriots to the cause of the American System included The Principles of Political Economy (1840), How to Outdo England Without Fighting Her (1865), Unity of Law (1872) and more. It was in The Harmony of Interests (1856) that Carey famously foretold of the emerging global fight between open vs closed systems that would define the post Civil War decades:

“Two systems are before the world; the one looks to increasing the proportion of persons and of capital engaged in trade and transportation, and therefore to diminishing the proportion engaged in producing commodities with which to trade, with necessarily diminished return to the labor of all; while the other looks to increasing the proportion engaged in the work of production, and diminishing that engaged in trade and transportation, with increased return to all, giving to the laborer good wages, and to the owner of capital good profits… One looks to pauperism, ignorance, depopulation, and barbarism; the other in increasing wealth, comfort, intelligence, combination of action, and civilization. One looks towards universal war; the other towards universal peace. One is the English system; the other we may be proud to call the American system, for it is the only one ever devised the tendency of which was that of elevating while equalizing the condition of man throughout the world.”

What did the “American System” Do?

While the British System of laissez fair free trade demanded that governments do nothing, regulate nothing and plan nothing in order for the magical creative animal spirits of the self-regulating markets to “do their thing”, the American System took a very different approach.

By applying protectionism, national banking, internal improvements and public credit, the American System was driven by the idea that “value” was located not in money or any material thing existent in the ephemeral “now” but rather in the development of the creative powers of mental activity of the people. Lincoln outlined this concept beautifully in his powerful “On Discoveries and Inventions” (1858) and this principle governed the creation of the Greenbacks when private bankers made every effort to cripple the Union’s access to credit needed to win the war.

Using protection, all nations have the right and even duty to prevent the cheap dumping of foreign goods by imposing a tariff upon imports, thus ensuring that local production be favored. Dumping was an old practice of economic warfare which the British had honed since the 17th century crushing its colonies’ efforts to build up local manufacturing on countless occasions (and continues to be a key element of economic warfare masquerading behind the veneer of globalization in our current age).

As demonstrated in the LPAC documentary 1932, whenever American System-followers in Russia, Germany, Italy, Japan, China, Spain and France applied protection, rail, and dirigiste credit, prosperity, independence and abundance flourished. Whenever these policies were abandoned, those nations were crippled and manipulated into wars by foreign interests.

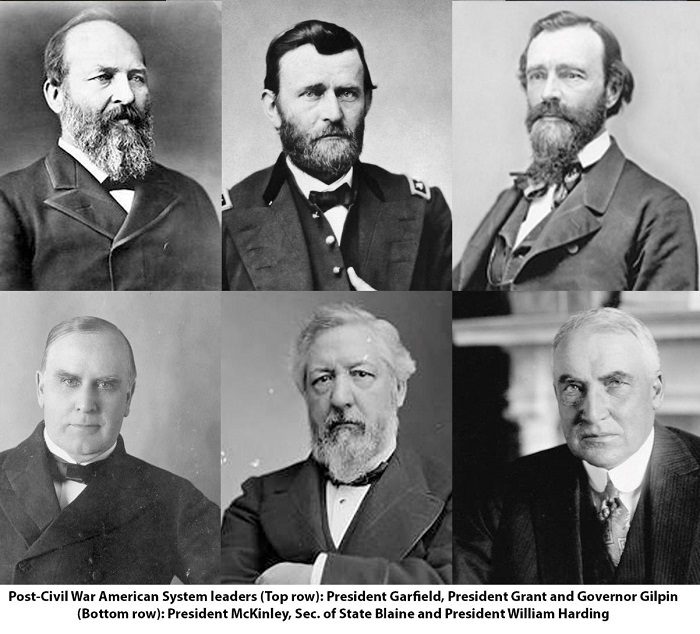

Between 1880-1930, this system was led by nationalist forces affiliated with President Garfield (1831-1881), President Ulysses Grant (1822-1885), Governor William Gilpin (1813-1894), President McKinley (1843-1901), Secretary of State James Blaine (1830-1893), and President Warren Harding (1865-1923). Each time it began to take hold the system was derailed by timely assassinations and it was only able to emerge once more in 1932.

How Franklin Roosevelt Revived the American System

With Roosevelt’s entry into office, the British Empire (using its Wall Street lackies) that had intentionally orchestrated the Great Depression in 1929 had realized that the American System was coming back to life for the first time in decades.

While Warren Harding’s short-lived presidency saw a few noble attempts to resurrect the McKinley-Lincoln traditions of the republican party, his convenient “death by oyster poisoning” in 1923 ensured that the revival of the American System would not succeed. Over Harding’s dead body, free trade, bank deregulation, and speculation ran rampant throughout the “roaring twenties” led by Andrew Mellon, the Morgan dynasty and their puppet Calvin Coolidge. This decay turned the once-productive industrial economy of America into a casino of bubbles built on unpayable debts and over-extended broker call loans that went up in smoke in 1929.

The “solution” that the financial oligarchy provided to the world in anticipation of the fear and starvation unleashed by the planned meltdown of the banking system was a novel economic miracle solution called “fascism”. This system soon swept the world from Italy, Germany, Austria and Spain. Within Britain, Canada and the USA, Wall Street/London sponsored fascist movements arose with lightning speed offering to solve all financial woes “and put food on the table” for millions of traumatized citizens. In a world of fear and instability, the masses were proving all too willing to ignore Ben Franklin’s sage advice by giving up their liberties to achieve a bit of security.

It was within this context that Franklin Roosevelt’s call to kick the money changers out of the temple and declare war on the abuses of Wall Street was an unexpected breath of fresh air for millions of suffocating citizens. With FDR’s sabotage of the 1933 London Conference, the empire gasped as their carefully laid plans for world government run by local fascist enforcers were going up in smoke. Wall Street’s assassination plot in February 1933 and a military coup plot in 1934 failed, as the Pecora Commission shone the light of truth upon the abuses of those bankers that created the great depression.

After putting dozens of leading bankers in prison, prosecutor Ferdinand Pecora described the operation years later: “Under the surface of the governmental regulation of the securities market, the same forces that produced the riotous speculative excesses of the ‘wild bull market’ of 1929 still give evidence of their existence and influence. Though repressed for the present, it cannot be doubted that, given a suitable opportunity, they would spring back to their pernicious activity.”

In Washington, a bi-partisan network of patriotic statesmen representing the Lincoln-McKinley-Harding traditions rose to prominence and shaped in large measure the policies which came to be known as the New Deal together with associated bank reforms of the Glass-Steagall, national credit, protectionism, and large-scale megaprojects known as the “four corners” vision (Tennessee Valley authority/Rural Electrification, Hoover Dam, Grand Coulee dam/Colorado River development, and St Lawrence Seaway).

Much like the Belt and Road Initiative today, these large-scale macro projects governed the tens of thousands of smaller state, county and municipal “micro” projects within a top-down dynamic.

The Keynesian Myth

Even though today’s popular narrative has asserted that FDR’s New Deal was a Keynesian innovation managed by the nebulous “Brain Trust”, the reality is that Keynes believed that FDR was a buffoon and FDR believed the Fabian eugenicist could only be considered a detached ivory tower mathematician but not a competent economist.

In her autobiography, FDR’s Secretary of Labor Frances Perkins recorded the 1934 interaction between the two men when Roosevelt told her: “I saw your friend Keynes. He left a whole rigmarole of figures. He must be a mathematician rather than a political economist.” In response Keynes, who was then trying to coopt the intellectual narrative of the New Deal stated he had “supposed the President was more literate, economically speaking.”

The ‘American System’ Caucus

Those forgotten forces who have been nearly written out of history were American statesmen who had battled against the Federal Reserve Act in 1913, stood up to the police state apparatus begun by Teddy Roosevelt’s FBI in 1908, and against America’s turn towards imperialism with the death of McKinley. They were the men who risked much to stand up against the League of Nations World government schemes launched in 1919, and against the Wall Street/CFR takeover of U.S. foreign and internal policy.

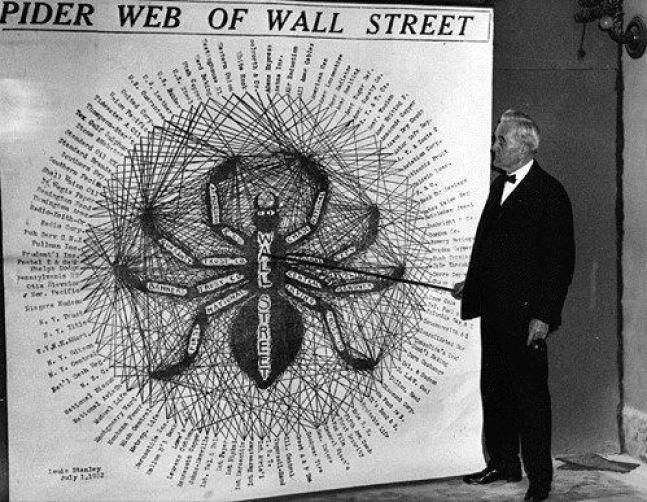

Senator George Norris showcasing the web of controls managed by the Wall Street oligarchs

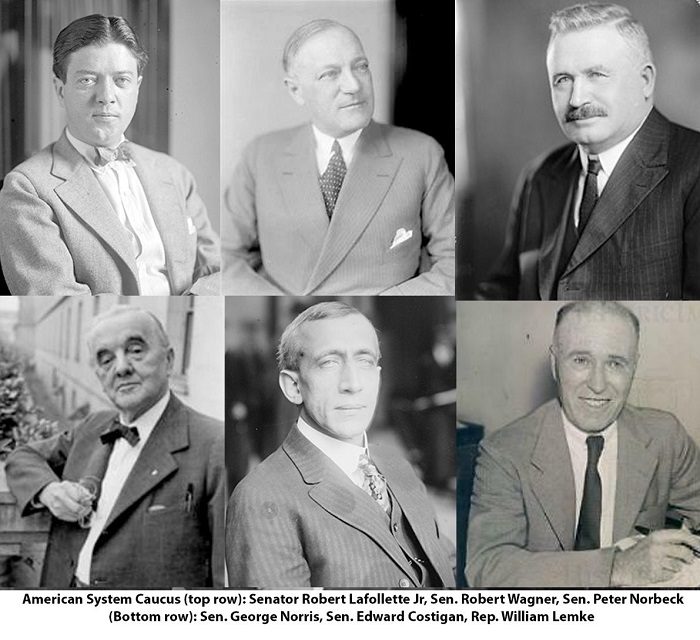

These names which should be celebrated today, interfaced closely with FDR and his allies Harry Hopkins and Henry Wallace. Some of their names include Senator Robert Lafollette Jr (R-Iowa) (1895-1953), Sen. Robert Wagner (D-NY) (1877-1953), Sen. Peter Norbeck (R-SD) (1870-1936), Sen. Edward Costigan (D-Colo.) (1874-1939), Senator George Norris (R-Neb) (1861-1944) and Rep. William Lemke (R-N.D.)(1878-1950). These were a few of the leading men that some historians have dubbed “the American System Caucus”, and while this article doesn’t leave room for their story, rest assured that more will be said about them in a future installment.

While it would be a lie to say that there was no such thing as a “Brain Trust” or that Keynesian economists and Rhodes Scholars were not to be found among this group, the idea that this was the “cause” of the New Deal is a pure fiction.

Taking Back Control of Credit Policy

While surgery was begun on the cancerous financial system and unpayable debts depriving the nation of the credit needed to commence a reconstruction policy of the physical economy (over 50% of U.S. industrial potential was destroyed and unemployment hit 25%), Franklin Roosevelt’s long time ally Harry Hopkins worked with Harold Ickes to provide emergency work for over 3 million people in the first months under the Public Works Administration and Works Progress Administration.

Although FDR could not destroy the private Federal Reserve that had taken control of U.S. monetary policy 30 years earlier, he was able to impose his own man (Marinner Eccles) onto it in 1934, forcing the beast to start obeying national law for the first time ever. Despite this maneuver, Wall Street oligarchs continued to sabotage FDR’s recovery by constricting credit, refusing to purchase treasury notes at strategic moments, or even speculating against the U.S. dollar itself. To get around these manipulations, the Reconstruction Finance Corporation (RFC) was brought online to function as a surrogate national bank channeling billions of dollars into small and medium businesses, industrial growth, and infrastructure projects.

Psy Ops vs the New Deal: The Rise of the Austrian School

Throughout the 1930s and 1940s, Mellon-Morgan-Rockefeller interests ran a multifaceted psychological war against the population. After their coup plans failed due to Gen. Butler’s brave whistleblowing in 1934, these groups created a think tank calling itself the “American Liberty League”. The irony of the word “Liberty” used by an organization whose controllers sponsored fascism before and even during WWII should not be lost on anyone.

Through powerful oligarchs like William Randolph Hearst, Henry Luce, the Morgans, the Warburgs, the Duponts, and the Rockefellers, the Liberty League controlled the majority of mainstream media outlets, radio stations, and publishing houses in the USA, at the same time they co-ordinated with the newly re-organized FBI under J. Edgar Hoover. These groups worked hard to paint FDR as a Keynesian who only created inflationary “make work jobs” without any concrete intention for the future productive powers of labor. Through this sleight of hand, FDR’s enemies were able to invent a straw man that they could then refute by promoting the anti-Keynesian model known as the “Austrian School” that had formerly grown out of the British System inspired theories of Carl Menger (retainer for the Habsburg empire) and his aristocratic disciples Ludwig von Mises, Friedrick von Hayek, Frank Knight, and Sir John Claphan.

By 1940, the American Liberty League formerly disbanded. However with FDR’s death its cabal of controllers spawned dozens of new think tanks that were enmeshed with the Council on Foreign Relations and Mont Pelerin Society mothership founded in 1947 by von Hayek and a group of eugenics-loving oligarchs whom we will encounter in a following report..

Over the coming decades, the Liberty League morphed into hundreds of new think tanks which began with the American Enterprise Association (AEA) [later American Enterprise Institute] founded by Liberty League leader Raymond Moley and sponsored by General Mills, Chemical Bank and Bristol Meyers.

Other think tanks built up by this network over the years included the Heritage Foundation, Cato Institute, Hudson Institute, Mises Institute, Manhattan Institute etc… which would set the groundwork for the later “conservative revolution” of the 1970s. This “Austrian School” revolution would spring to life once the 1945-1971 Keynesian perversion of Bretton Woods ended with the 1971 floating of the dollar off of the fixed exchange rate gold reserve system.

Under this post-1971 era, a new god of the “markets” would replace the old god of “the state” and a new ethic of post-industrial consumerism would replace the former system of Keynesian controls that defined the post-WWII era. Those anti-Keynesian leaders of the American System tradition such as Henry Dexter White, Franklin Roosevelt, Wendell Wilkie, Sumner Welles, and Harry Hopkins were taken out of power through various means between 1945-1946 as the Anglo-American establishment regained control over U.S. foreign and internal policies. This Keynesian takeover destroyed the positive potential of the Bretton Woods Institutions which were designed originally to internationalize the New Deal via the creation of cheap credit for global development and win-win cooperation.

In our next installments, we will look more deeply into the sordid minds and political operations controlling the figures of John Maynard Keynes and Friedrich von Hayek.

Authored by Matthew Ehret via The Strategic Culture Foundation