Crowdfunding has led to the success of thousands of startup ventures around the globe. But those who are unfamiliar with crowdfunding as a concept might not know which type best fits their business plan. Here, we will tell you about three different types of crowdfunding. We will explore which option is the best fit for what type of business. Also, we will tell you why that is the case. Hopefully, you can get a better idea for what sort of crowdfunding might work the best for you by reading this simple to understand article.

Lending

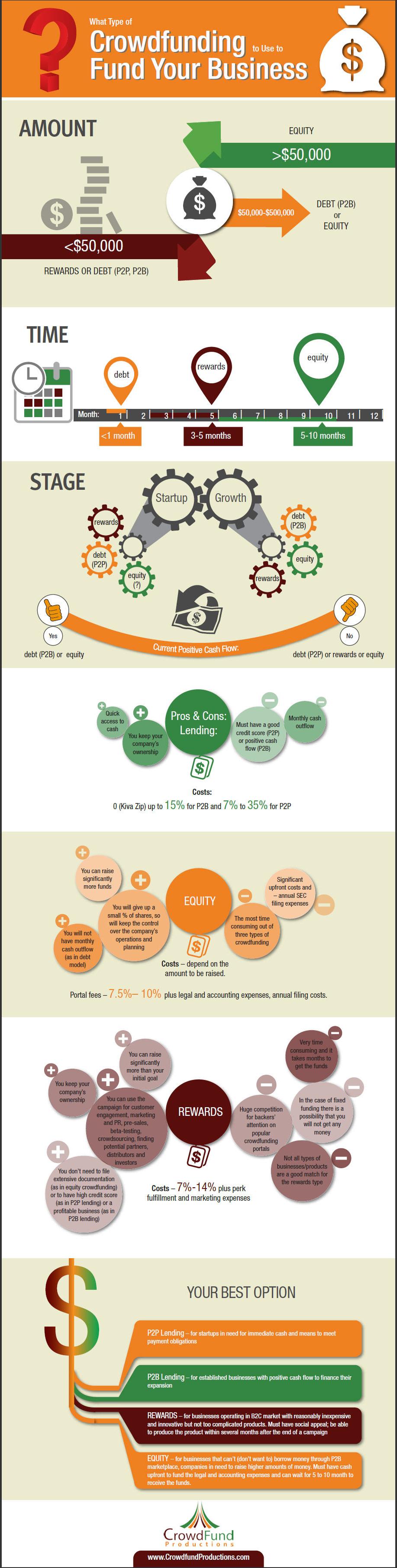

Lending comes in two forms: P2P and P2B. Consider either of these options if you have from $50,000 to $500,000 dollars that you need. P2P is the best option for startups. It will get you cash quickly, even if you do not have a positive cash flow. P2B is best if you are already a well-established business who just would like to expand. In this case, you will have a positive cash flow each month. Understand that both of these options will mean you will have to pay a monthly payment out of your profits.

Equity

Equity is the idea of selling a portion of stocks in your company. When you do this, you will have money to invest back into your business. However, this means you could miss out on future profits. This type of crowdfunding also takes the longest to reach your financial goals. On the bright side, with this model you will not have to pay any extra money out from your business each month, as you would with a loan. We only recommend this route if you need more than $50,000 in capital to get your business going. It will take from 5-10 months to reach your goal, too.

Rewards

Rewards is another crowdfunding option. It is faster than raising the money through equity, but slower than seeking a loan. For this to work well, you should be producing a product that has mass social appeal. In this model, you raise funds from outside backers. Think about using popular crowdfunding sites to do this work for you. With this sort of crowdfunding, you get to keep ownership of every part of your company, too. This works less if you are seeking less than $50,000 in startup capital. Just expect the competition to be stiff for funding, here.

Strong proponent of individual liberty and free speech. My goal is to present information that expands our awareness of crucial issues and exposes the manufactured illusion of freedom that we are sold in America. Question everything because nothing is what it seems.