Businesses exist in a cutthroat world where every dollar matters. This is especially true for small businesses that are working to grow and expand while also learning the ropes. There may come a time when additional funding is required but not immediately on hand. That is where capital funding comes in. Let’s take a look at the capital funding model, with a specific interest in the best and worst aspects associated with this kind of loan.

Is A Capital Loan Worthwhile for a Small Business?

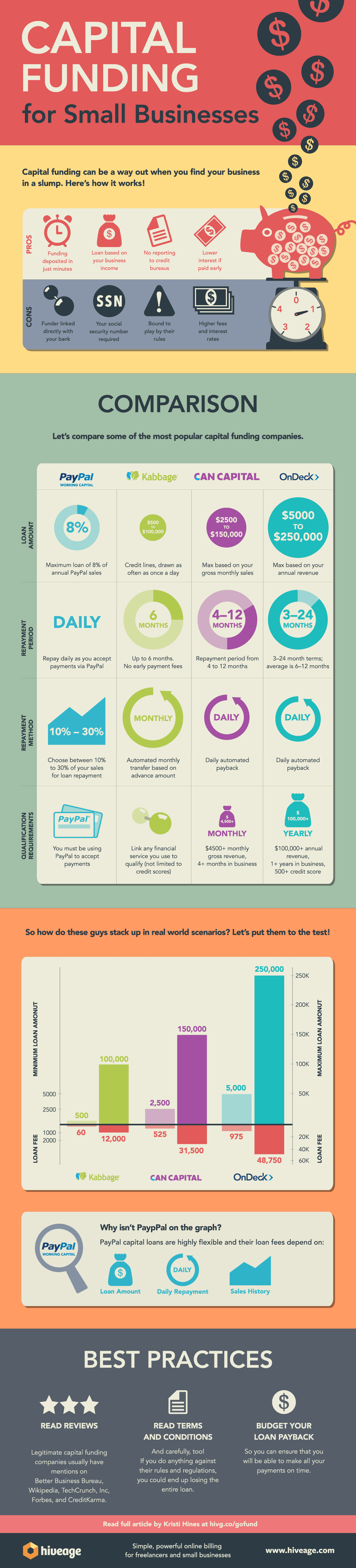

When it comes to a capital loan, there are many benefits. The first is that you receive your funding very quickly. In fact, it can take only a few minutes once everything is signed before your small business gets the money it needs. In addition to this, the loan repayment plan can be tailored to your income model. Third, there is no reporting to your credit bureaus. Finally, the loan can be set up in such a way that low interest is paid at the beginning, allowing you the time you need to invest that money into growing your business.

What Are Some Popular Sources for Capital Funding?

When it comes to finding capital for a small business, there are many options. Some of the most popular choices include OnDeck, CAN Capital, Kabbage, and Paypal. What you decide on will be based on the needs of your company. For example, if you require $150,000, then Kabbage is out (With their max of $100,000) and PayPal is only an option if the $150,000 you are looking for is greater then 8% of your net sales. In addition, other factors you may want to consider is qualification requirements, repayment methods, and repayment periods. Every lender for small businesses will be slightly different.

How to Safeguard Yourself

When it comes to taking out a loan for a small business, there are several things you should consider prior to signing a contract. The first thing to consider are reviews. How have other people experienced the lender, and what do they think after having gone through the process? What about the terms and conditions of the loan? Be sure to read these carefully, as hidden fees may apply. The last thing to consider is budgeting for your loan once you take it. Though an initial amount of capital is wonderful at the beginning, being able to pay it back over time is even better.

Strong proponent of individual liberty and free speech. My goal is to present information that expands our awareness of crucial issues and exposes the manufactured illusion of freedom that we are sold in America. Question everything because nothing is what it seems.