Small businesses face numerous challenges. Unfortunately, most of those challenges are recurring and there are seldom any long term solutions to those problems. The premise or the world of a small business is very different from a large company or even from that of a startup. A small business has limited scope of amassing wealth or a fortune. There is almost no to minimal scope of growth and certainly almost nonexistent opportunity for expansion, unless there is a ready virgin market and the resources are available, including finance.

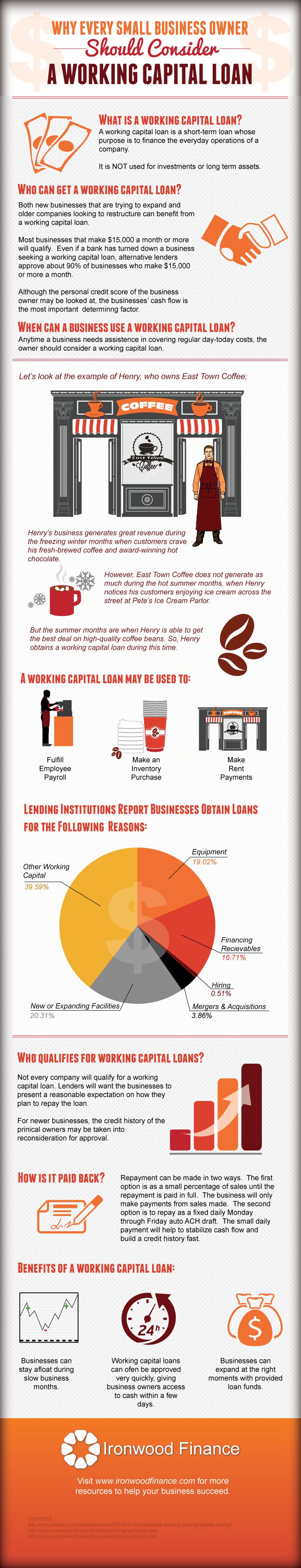

It is due to the very nature of a small business that its owner should consider a working capital loan. A working capital loan is not strictly a business loan, although it is only available for businesses. It is not a business loan in the sense that a company cannot opt for such a loan if it wishes to invest a large sum of money into business expansion or to procure certain large scale equipment or to get started with a business. Working capital loan is usually of much smaller amounts than corporate loans or what are referred to as business loans. A working capital loan is issued by banks and mainstream financial institutions but there are many alternate lenders as well.

A working capital loan is a necessity for most small business owners and it can make a difference between staying afloat and shutting down a shop. In the associated info-graphic, you can explore why a working capital loan is so important and how it can be a savior for small businesses.

Most small businesses go through a cycle of good phase and bad phase. This cycle is a perennial phenomenon. Some small business owners prepare for rainy days and they make compromises in their personal lives to keep the business afloat and to ensure sustainability. While such measures or approaches are noble and effective, it is not undesirable or unwise to opt for an alternative which can allow a small business owner to see through the bad days without compromising on what he or she needs in their personal lives.

Getting a working capital loan is not a daunting challenge and there are many options these days. Such a provision or an opportunity can always help a business, in good times or bad. From attending to recurring expenses to making upgrades in the business, a lot can be achieved with a working capital loan.

Strong proponent of individual liberty and free speech. My goal is to present information that expands our awareness of crucial issues and exposes the manufactured illusion of freedom that we are sold in America. Question everything because nothing is what it seems.