Understanding how to use effective business financing strategies can help your business in a variety of different ways. Whether you are interested in growing your business quickly, expanding your business, or having the ability to take advantage of business opportunities as they arise, smart financing can be quite useful. If you’re interested in business financing, there are numerous reasons as to why you will want to take the following information into consideration.

Why You Should Apply for Business Financing

1. Financial Flexibility

Every business has those customers that take a long time to pay what they owe. With business financing, you don’t have to crunch pennies.

2. Taking Advantage of Discounts

There are thousands of vendors that offer their products on special discounted rates that can benefit your business. Instead of waiting for the funding to be available, business financing allows you to take advantage of these products immediately.

3. Taking Care of Your Business

There are many different objects in your business that may require repairs or need to be replaced. This allows you to have the funds available to do so as needed.

4. Paying Bills

This is vital to ensuring your vendors, liens, and taxes are paid on time.

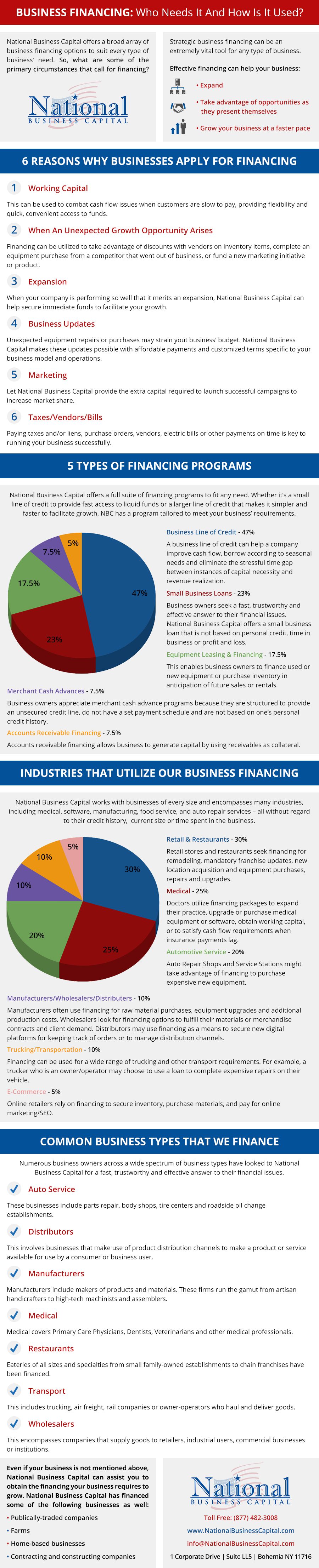

Financing Options

When you begin researching what business financing has to offer, you may become aware of the different financing options that are open to you. Depending on your financial situation, some options may be better than others.

1. Business Line of Credit

This helps businesses to grow their overall amount of cash flow and borrow money according to what they need during specific times of the year.

2. Small Business Loans

If you’re looking for quick and fast money that will be the solution to your financial issues, small business loans are great. These offer the added benefit of not being intermingled with personal credits or losses associated with your business.

3. Equipment Leasing and Financing

If your business has used or new equipment, leasing or financing it instead can offer the added benefit of maintaining a positive cash flow on hand.

4. Merchant Cash Advances

Cash advances are preferable for individuals who are interested in acquiring money that isn’t based on their personal credit history or that have a set schedule for repayment.

5. Accounts Receivable Financing

Businesses that need to generate capital can use their accounts receivable as a form of collateral for their financing needs.

Strong proponent of individual liberty and free speech. My goal is to present information that expands our awareness of crucial issues and exposes the manufactured illusion of freedom that we are sold in America. Question everything because nothing is what it seems.