Every business, whether large or small, requires a sufficient amount of funding to operate consistently throughout the year. With the constant flux in the economy, it is becoming more and more difficult for businesses to find the money that they need to keep their doors open. This is why many business owners find themselves looking into traditional bank loans, when in reality, they have the opportunity to take advantage of accounts receivable financing. One method may be more preferable for one business whereas the other may have advantages for a different business.

What is Accounts Receivable Financing?

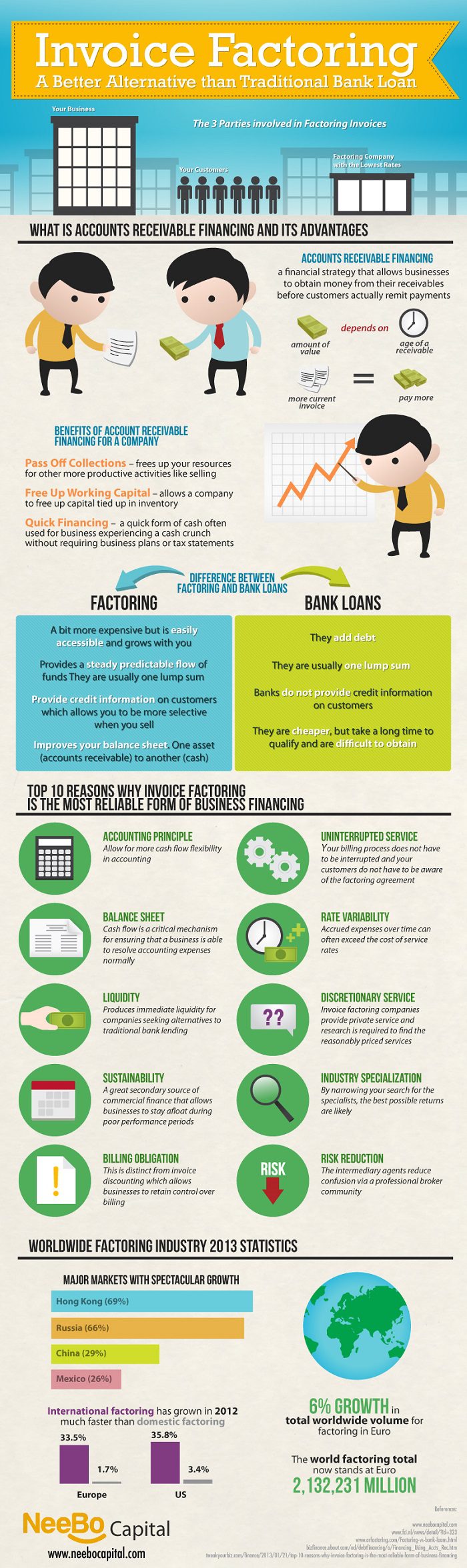

The one issue that companies face when they attempt to sign for a traditional bank loan is their line of credit. Instead of having to go through this process, business owners can easily acquire money from their receivables prior to customers remitting payments. There are different benefits associated with accounts receivable financing ranging from it being a relatively quick process to allowing your business to free up your capital that could be tied up in your inventory.

What are Bank Loans?

Bank loans have always been in existence but just because they have been available for a long period of time doesn’t mean that they are the best option for you. Bank loans are renowned for adding debt, they are received in one giant sum, and banks won’t provide you with credit information on customers. Though they are a cheaper alternative to accounts receivable financing.

Other Benefits of Accounts Receivable Financing

This method of acquiring extra funding provides you with a stable source of cash flow and it also allows you to improve your annual balance sheets. Although it is the more expensive option, it will grow with you and you can easily access it whenever you need money. Also, it allows you to acquire credit information on your customers that allows you to choose you want to sell to.

6 Reasons to Choose Invoice Factoring

1. Allows more flexibility and cash flow.

2. Billing processes will not be interrupted and your customers won’t know about your factoring agreement.

3. Provides companies with immediate liquidity instead of having to wait for generic bank lending.

4. Allows companies to stay in the green, even if their performance is poor for a few months.

5. Provides you with the best possible returns.

6. Reduces the amount of risk for professional brokers.

Strong proponent of individual liberty and free speech. My goal is to present information that expands our awareness of crucial issues and exposes the manufactured illusion of freedom that we are sold in America. Question everything because nothing is what it seems.